For Chief Financial Officers (CFOs), the burden of managing their company’s financial health relies on informed and critical decision-making. One such decision deals with the choice between outsourcing accounting services or keeping them in-house. Although both options come with their fair share of pros and cons, selecting the option that is ideally suited for their company could potentially make or break the company’s bottom line.

Let’s compare the salient features of outsourcing versus in-house accounting and how they impact a company:

Hiring a third-party firm to manage a company’s finance and accounting tasks is the crux of outsourcing. This approach offers several advantages, especially in terms of efficiency and expertise.

Primarily, outsourcing accounting enables CFOs to leverage a pool of specialized professionals who are experts in accounting practices and trends. These professionals can derive meaningful insights from the company’s data to deliver strategic financial advice that is customized to suit the company’s needs and goals. Additionally, outsourcing frees up internal resources, enabling them to focus more on high-value tasks and core business activities instead of devoting their time to mundane tasks.

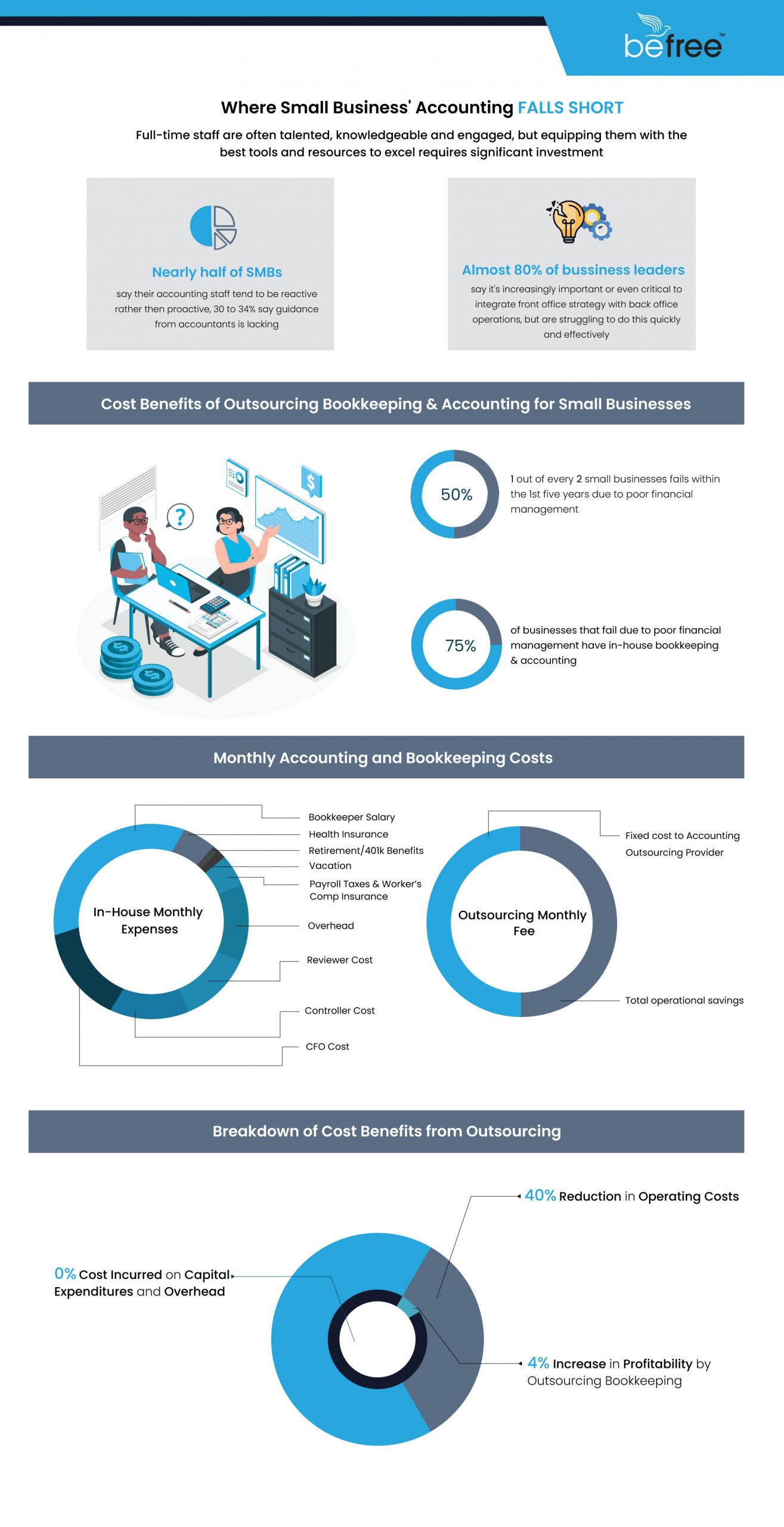

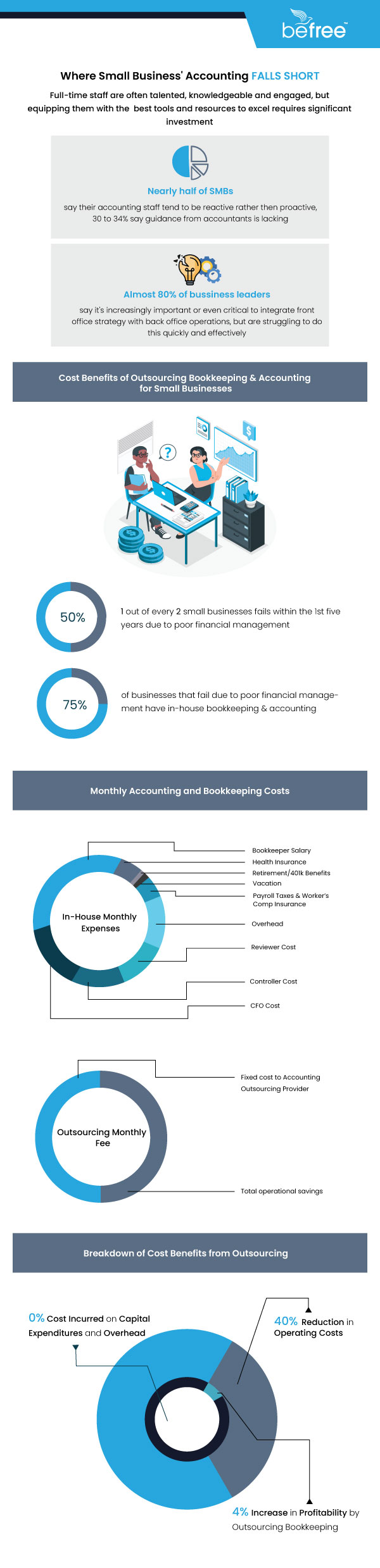

Also, outsourcing accounting is usually more cost-effective than having an in-house accounting department. Outsourcing allows CFOs to navigate the need for hiring full-time staff, offering benefits, or investing in expensive technology and subsequent training. Instead, the company only pays for the services they need with the option of scaling and adapting them as and when they need them.

As mentioned above, the outsourcing model embraces scalability and flexibility, enabling companies to pivot strategically and more efficiently. Regardless of the need for additional support during tax season or potentially venturing into a new market, outsourcing firms can modify their services to suit the client’s requirements without compromising on output.

Conversely, having an in-house accounting team does provide greater control and integration within a company. Using an in-house team, CFOs can maintain direct oversight of their financial operations and ensure compliance with internal policies and procedures.

Relying on in-house accountants also integrates a deeper understanding of the company’s financial situation and capabilities within their staff. Leading to better collaboration and transparency, as the accounting department interacts with other departments to align financial goals with the trajectory of business objectives.

Additionally, the availability of an in-house team provides real-time access to financial data, resulting in quicker decision-making and strategic planning. This allows any issues or concerns that pop up to be quickly addressed without depending on external parties for support.

However, deploying an in-house accounting department comes with its share of challenges. Hiring and retaining qualified accounting professionals tends to be expensive and time-consuming. Furthermore, this will be further compounded by investing in training and development for the team to ensure they are well-versed with the latest accounting standards and regulations.

Lastly, in-house accounting is generally quite rigid in comparison to outsourcing, especially during peak business traffic or when specialized expertise is required, resulting in an understaffed or overwhelmed team by the scope of work at hand. This can lead to delays and also costly errors when it comes to delivering financial reports.

Ultimately, the decision to outsource or employ an in-house accounting department depends upon each company’s unique needs, priorities as well as resources. Before making a decision, a CFO needs to consider several factors including cost, expertise, flexibility, control, and scope of work.

Evaluating the current capabilities of the internal team and assessing them against the benefits of outsourcing is an excellent way to determine which option suits the company’s strategic objectives and long-term goals.

Remember, the objective here is to enhance financial performance while decreasing risks and maximizing returns. Regardless of which option CFOs decide, it is vital to prioritize transparency, communication, and collaboration to ensure seamless financial management and drive sustainable growth for their company.

At befree, we help companies achieve their financial goals through our extensive expertise in best industry practices, compliance and the latest technologies, all while remaining cost-effective to your budget. For more information regarding our products and services, and how we would be able to add value to your organization, please visit befreeltd.com/au/