Paraplanning services have become indispensable in the financial planning industry. It plays a crucial role in supporting financial advisers by handling complex, time-consuming tasks, allowing advisers to focus on building client relationships and strategic planning.

This blog post explores the core value of paraplanning services and examines how technology, strong relationships, and clear communication contribute to their effectiveness.

The Core Value of Paraplanning Services

Support Role for Advisers

Financial advisers are the face of financial planning, interacting with clients and crafting personalised strategies.

However, behind the scenes, paraplanners are hard at work. They relieve advisers of time-consuming tasks like research, data analysis, and report generation. This allows advisers to focus on building client relationships and making strategic decisions without getting bogged down by administrative details.

For example, a paraplanner might be responsible for gathering and analysing client data, preparing financial reports, and conducting investment research. By taking care of these tasks, they enable advisers to be more present for their clients, resulting in stronger relationships and better service.

Quality and Compliance

Quality and compliance are vital in financial planning, and paraplanners play a key role in maintaining both. They are responsible for ensuring that all data is accurate and up-to-date, reducing the risk of errors in financial plans. Moreover, they help ensure that financial planning practices adhere to regulations, providing a critical safety net for firms.

By keeping abreast of regulatory changes and industry best practices, paraplanners contribute to a higher standard of compliance. This not only protects the firm from potential legal issues but also ensures that clients receive reliable and compliant financial advice.

Efficiency and Productivity

Paraplanning services are designed to streamline workflows, enabling financial planning firms to operate more efficiently.

By taking on administrative tasks, paraplanners free up advisers’ time, allowing them to serve more clients effectively. This increased efficiency can lead to greater productivity and, ultimately, more successful financial planning practices.

For example, by utilising specialised software and tools, paraplanners can quickly generate reports and conduct analyses that would otherwise take advisers a significant amount of time. This increased productivity benefits both the firm and its clients.

Client Experience

The client experience is a top priority in financial planning, and paraplanners significantly contribute to its enhancement. With accurate information and comprehensive reports provided by paraplanners, advisers can develop and present personalised financial plans that resonate with clients. This attention to detail builds trust and confidence, leading to higher client satisfaction and loyalty.

Moreover, paraplanners often play a role in preparing client presentations and ensuring that all client-facing materials are clear and professional. This further enhances the client experience by providing a polished and reliable service.

Leveraging Technology in Paraplanning

Advanced Tools and Software

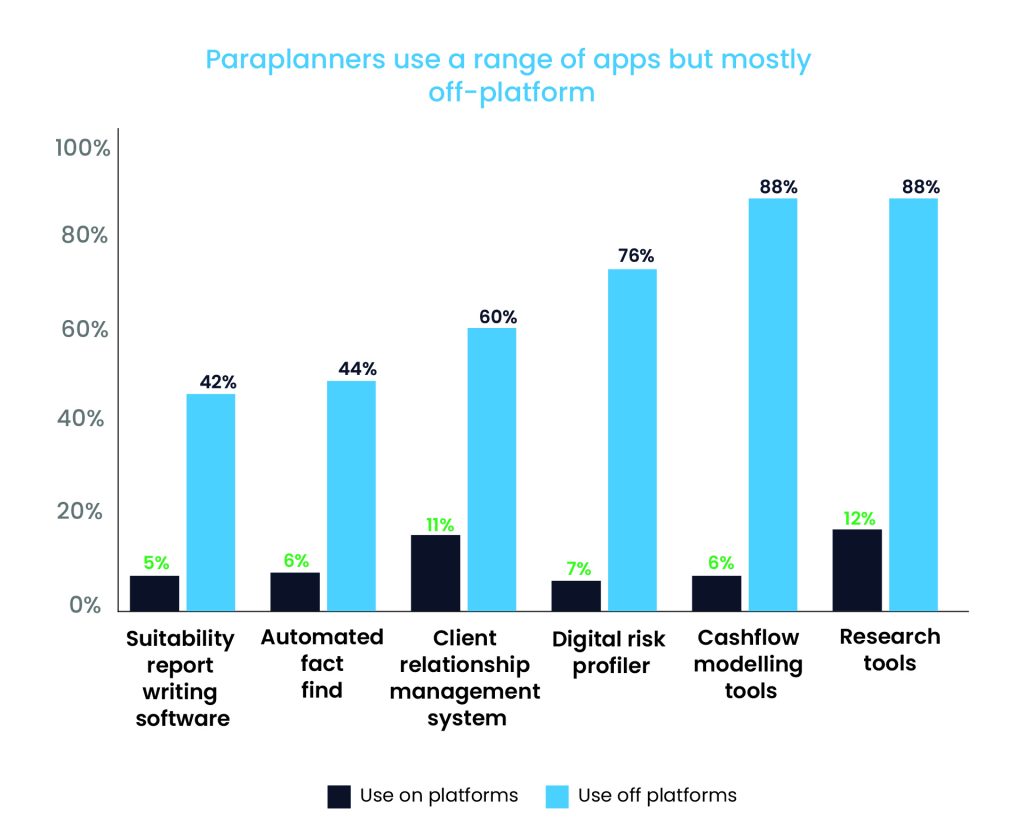

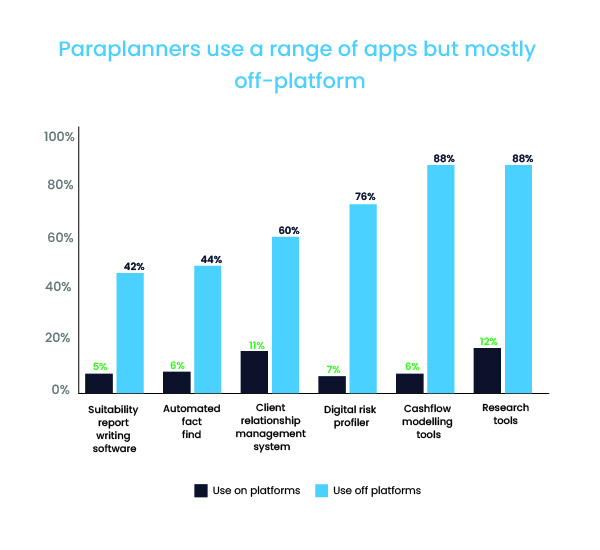

Technology plays a central role in paraplanning, with advanced tools and software streamlining processes and improving accuracy. Paraplanners often use customer relationship management (CRM) systems to manage client data, financial planning software tools to create detailed plans, and data analysis tools to evaluate investment options.

These technologies allow paraplanners to work more efficiently and produce high-quality results.

Remote Collaboration

The rise of remote work has made remote paraplanning more feasible, enabling firms to access talent from anywhere. This flexibility is a game-changer, as it allows financial planning firms to build teams with diverse skills and backgrounds without geographic constraints.

Remote collaboration tools, like video conferencing and cloud-based document sharing, facilitate seamless communication between advisers and paraplanners, ensuring that work continues smoothly regardless of location.

Automation and Efficiency

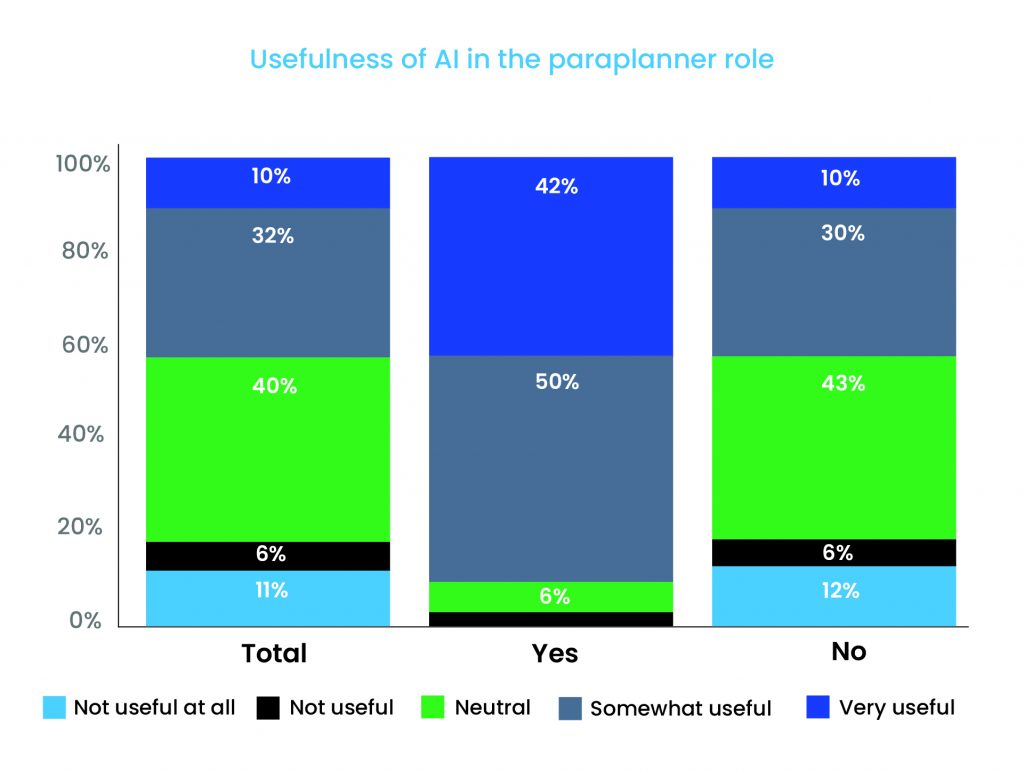

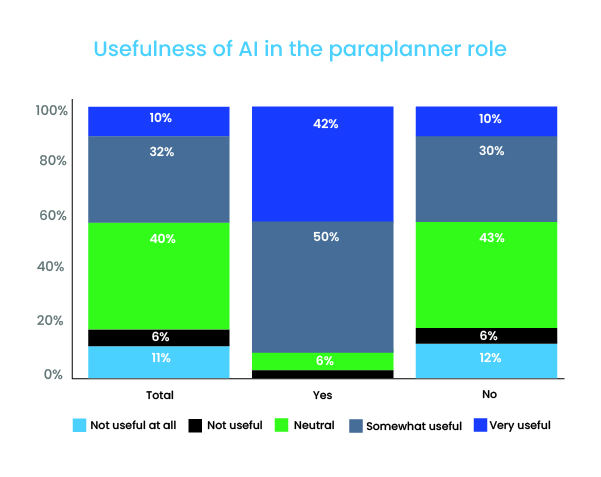

Automation is transforming paraplanning by allowing paraplanners to automate routine tasks, such as data entry and report generation. This automation not only saves time but also reduces the risk of human error, leading to more reliable outcomes.

With automation, paraplanners can focus on more complex tasks that require analytical thinking and creativity, further enhancing their value to advisers.

Building Strong Adviser-Paraplanner Relationships

Collaboration and Communication

A strong relationship between advisers and paraplanners is essential for seamless service delivery. Effective collaboration relies on clear communication, where advisers and paraplanners discuss client needs, expectations, and timelines.

Regular check-ins and feedback sessions help ensure that everyone is aligned and working towards common goals.

Setting Clear Expectations

Setting clear expectations is crucial to a productive working relationship between advisers and paraplanners. Both parties should understand their roles and responsibilities, and establish processes that support efficient collaboration.

For example, outlining the steps for data collection, report generation, and client presentation ensures that everyone knows what to do and when to do it.

Clear expectations also help avoid misunderstandings and allow for a smoother workflow. By fostering a culture of open communication and teamwork, financial planning firms can create a more effective and harmonious working environment.

Conclusion

Paraplanning services are a cornerstone of financial planning, providing vital support to advisers and enhancing the client experience. By leveraging technology, embracing automation, and fostering strong relationships, financial planning firms can make the most of paraplanning services. As the industry continues to evolve, paraplanners will play an increasingly important role in ensuring quality, compliance, and efficiency in financial planning.

Ready to optimise your financial planning process?

Let’s build a stronger, more efficient financial planning practice.