Are you tired of feeling overwhelmed by your business’s finances? Do you wish there was a foolproof way to keep your accounts in order and gain clearer insights into your financial health? Double-entry bookkeeping might be the solution you’re looking for.

If you own a small business, understanding the double-entry system can be a game-changer for your financial management practices. This comprehensive accounting framework, also known as double-entry accounting, requires every financial transaction to be recorded twice, once as a debit and once as a credit, ensuring that the accounting equation, assets = liabilities + equity, always remains balanced.

To give you a clear understanding of double-entry bookkeeping, this guide will cover the following key areas:

What is Double-entry Bookkeeping?

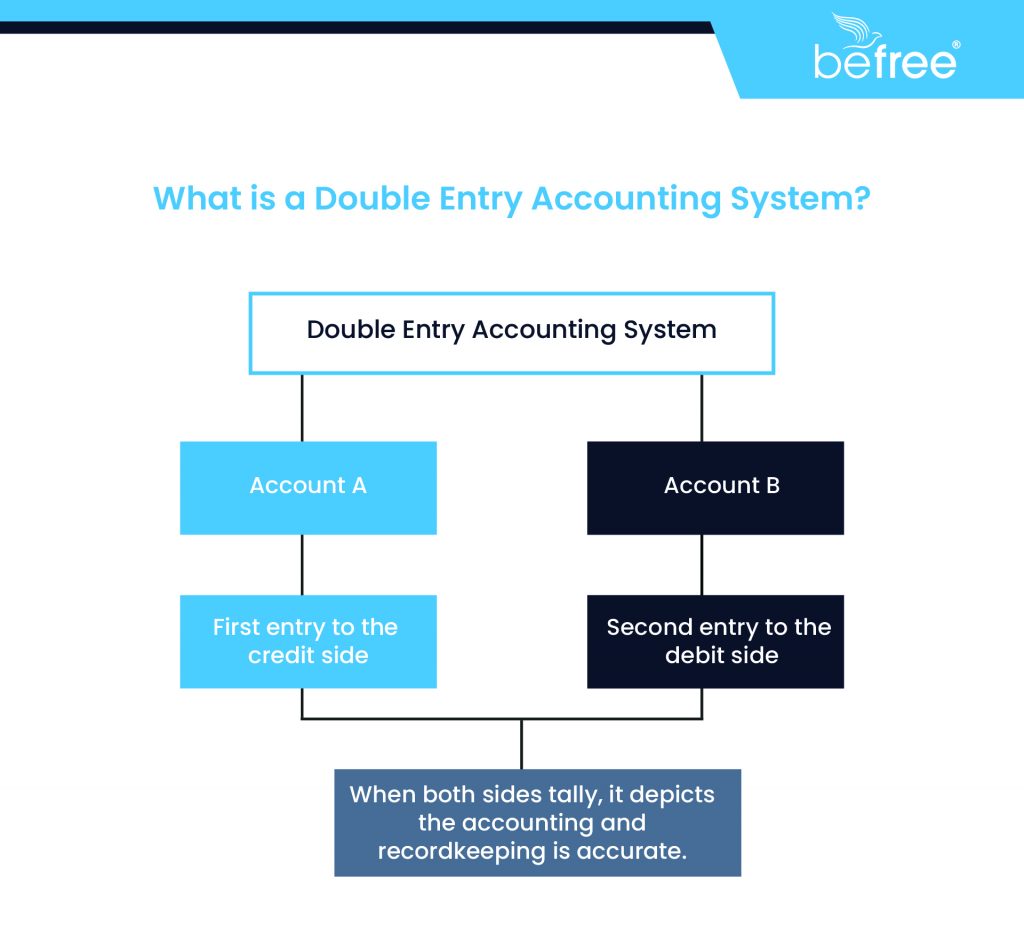

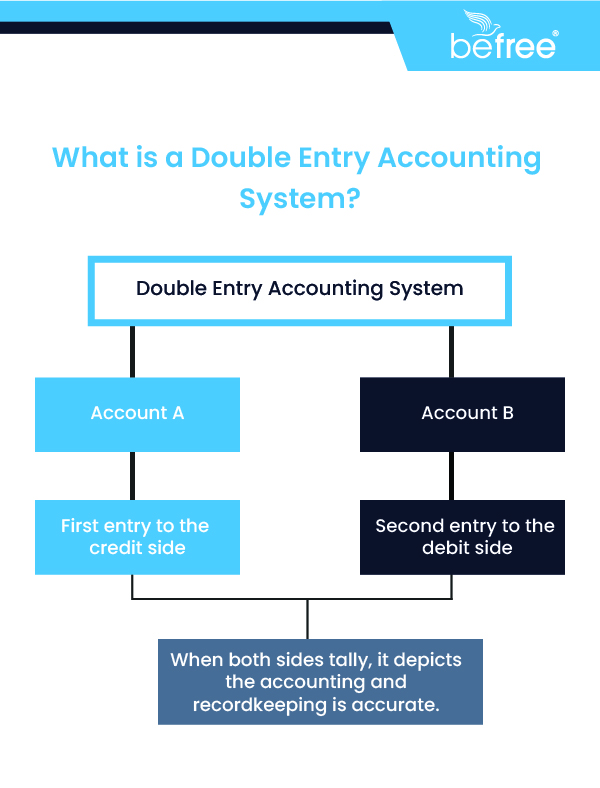

Double-entry bookkeeping is an accounting system in which every financial transaction is recorded in at least two accounts: a debit in one and a credit in another. The core principle of double-entry bookkeeping is that every debit entry must have a corresponding credit entry, and vice versa.

Also Read: How Outsourcing Bookkeeping to India Benefits Your Company

Principles of Double-entry Bookkeeping

- Duality Concept: Every transaction has a dual effect, meaning it impacts at least two accounts.

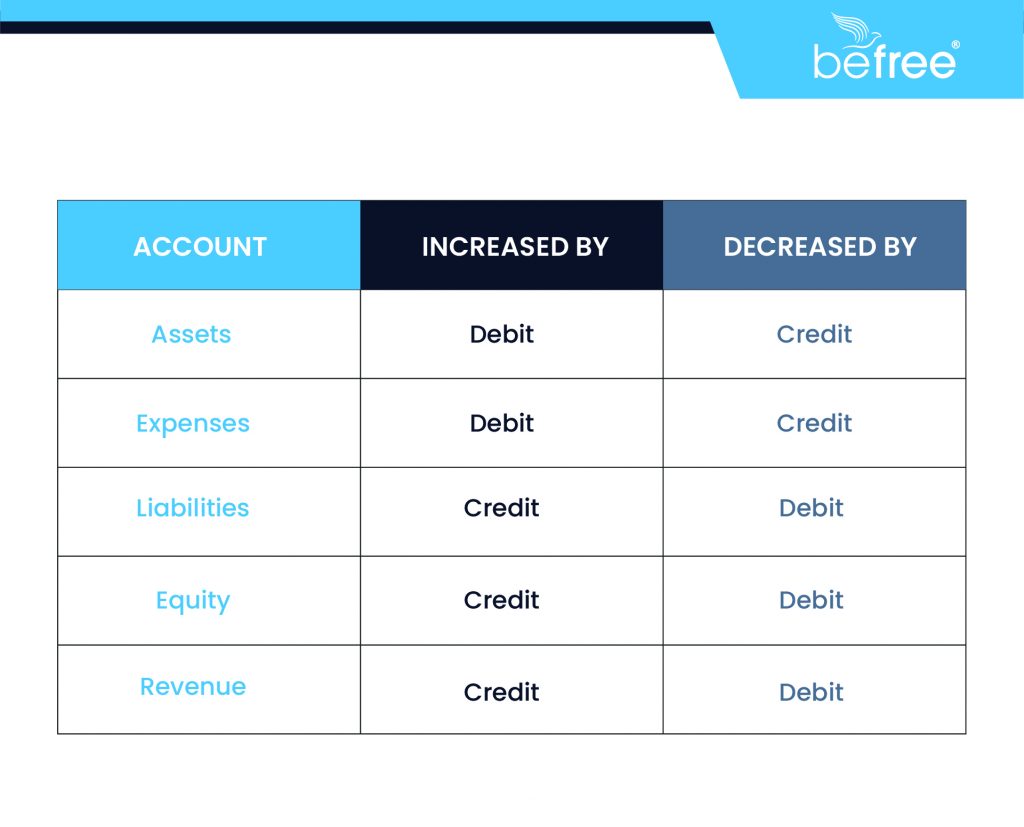

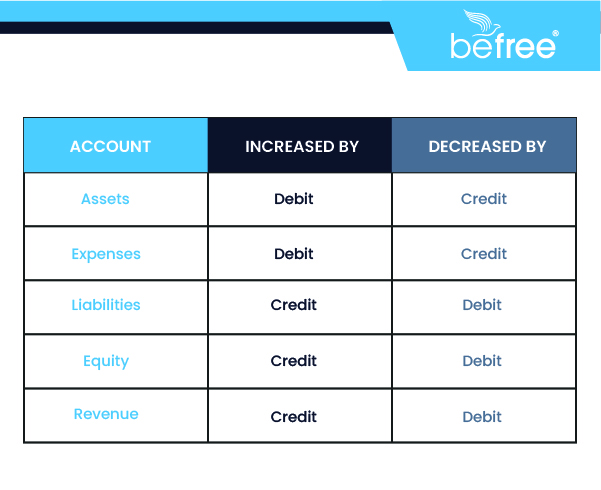

- Debit and Credit Rules: Assets and expenses increase with debits and decrease with credits. Liabilities, equity, and income increase with credits and decrease with debits.

- Accounting Equation: The total value of assets always equals the sum of liabilities and equity.

Why Is Double-Entry Bookkeeping Important?

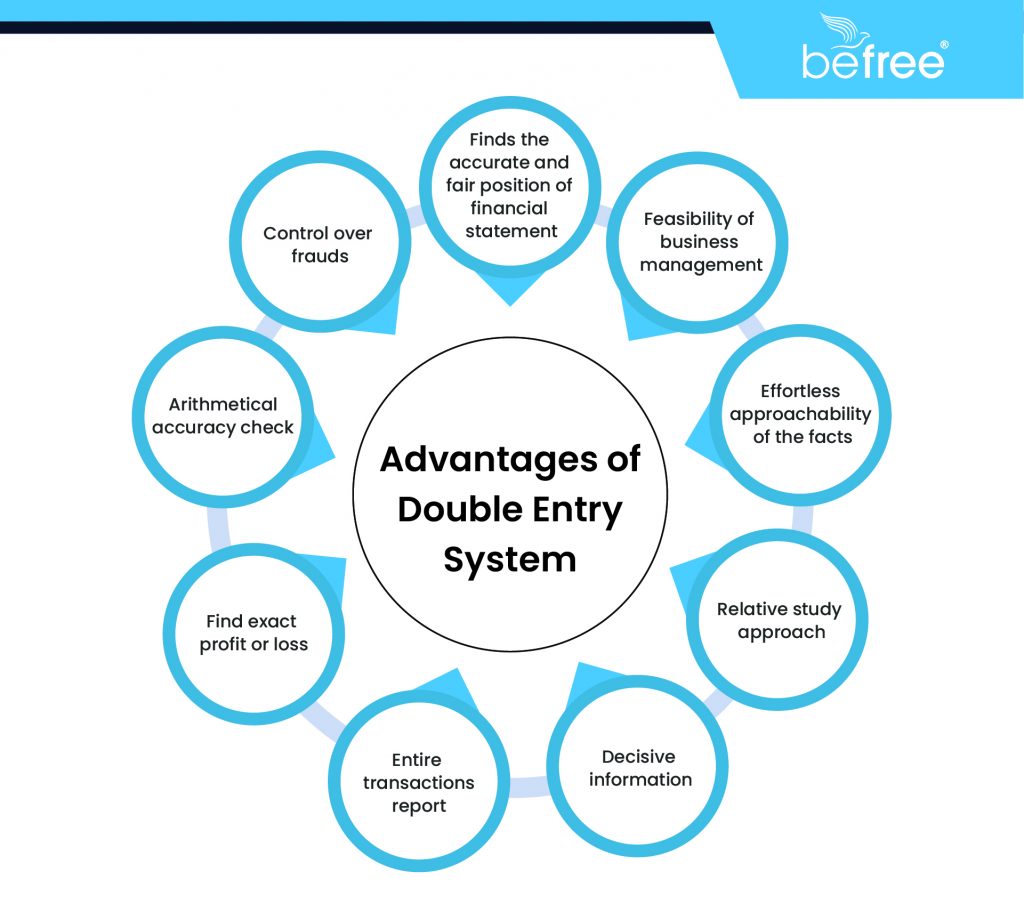

Double-entry bookkeeping offers several benefits, making it an essential practice for small businesses:

- Accuracy and Reliability: The system minimises errors by ensuring that every transaction is recorded twice, which helps in cross-verifying the entries.

- Financial Insights: It provides a comprehensive view of the financial health of the business, allowing for better decision-making.

- Compliance: Many regulatory bodies require businesses to maintain records using double-entry bookkeeping for transparency and accountability.

- Fraud Prevention: The dual-entry nature makes it difficult to conceal fraudulent activities, as discrepancies are more likely to be detected.

How to Implement Double-entry Bookkeeping

Implementing double-entry bookkeeping can seem daunting for small business owners, but breaking it down into steps can simplify the process. Let’s take a look at each step in detail.

1. Set Up a Chart of Accounts

A chart of accounts is a list of all the accounts used by a business. These accounts are categorised into assets, liabilities, equity, revenue, and expenses. This setup will serve as the foundation for recording transactions.

2. Record Transactions

Every financial transaction should be recorded as a journal entry. Each entry must include:

- The date of the transaction

- The accounts affected

- The amounts debited and credited

- A brief description of the transaction

For example, if you purchase office supplies for $500, you would debit the office supplies expense account and credit the cash account.

3. Post to the General Ledger

After recording transactions in the journal, they need to be posted to the general ledger. The ledger summarises all transactions by account, making it easier to prepare financial statements.

4. Prepare a Trial Balance

A trial balance is a report that lists the balances of all ledger accounts. It ensures that debits equal credits, confirming the accuracy of the entries. Any discrepancies must be investigated and corrected.

5. Generate Financial Statements

A trial balance is a report that lists the balances of all ledger accounts. It ensures that debits equal credits, confirming the accuracy of the entries. Any discrepancies must be investigated and corrected.

- Balance Sheet: Shows the financial position at a specific point in time.

- Income Statement: Summarises the revenues and expenses over a period, showing profit or loss.

- Cash Flow Statement: Tracks the inflow and outflow of cash, highlighting the liquidity position.

Tips for Maintaining Double-entry Bookkeeping

- Stay Organised: Keep all financial documents, such as invoices and receipts, well-organised and easily accessible.

- Use Accounting Software: Consider using accounting software designed for small businesses. These tools can automate much of the double-entry bookkeeping process, reducing manual errors and saving time.

- Regular Reviews: Conduct regular reviews of your accounts to ensure accuracy and to catch any errors early.

- Seek Professional Help: If you’re unsure about any aspect of double-entry bookkeeping, consult with an accountant. They can provide guidance and ensure your books are in order.

Conclusion

Mastering double-entry bookkeeping can significantly improve your small business’s financial management. By understanding and implementing this double-entry system, you’ll ensure that your records are accurate, reliable, and compliant with regulatory standards. This robust double-entry accounting and bookkeeping method not only provides comprehensive financial insights but also helps in preventing fraud and making informed decisions. Don’t let financial chaos hold your business back—adopt the principles of double-entry bookkeeping today.

Want to make informed financial decisions with confidence?

Click the button below to discover how our expert services can help you implement double-entry bookkeeping seamlessly.