Running a business means juggling countless expenses, and it’s easy to feel overwhelmed most of the time. At some point, the traditional bookkeeping methods just don’t cut it anymore. That’s where a virtual bookkeeper and a solid bookkeeping services list can come in handy, taking your business to the next level.

Imagine focusing on what you do best, without the constant stress of managing financial records. You can do just that by outsourcing your bookkeeping to a virtual bookkeeper. A virtual bookkeeper handles it all, ensuring everything is accurate and up-to-date. This way, you can spend time on what truly matters—growing your business, serving your customers, and making your vision a reality.

So why struggle with outdated systems when you can outsource your bookkeeping to a professional who will keep your finances in order, letting you get back to what you love?

Bookkeeping Services List: What to Expect from Outsourcing

In this blog, we will discuss the essential services provided by virtual bookkeepers and how outsourcing these tasks can transform your business operations.

Your business might be earning $100K or more in annual revenue, but you still need a simple, quick, and safe way to log expenses. This is where virtual bookkeeping services come into play.

Beyond just tracking and managing your expenses, virtual bookkeepers play a crucial role in helping you make informed business decisions.

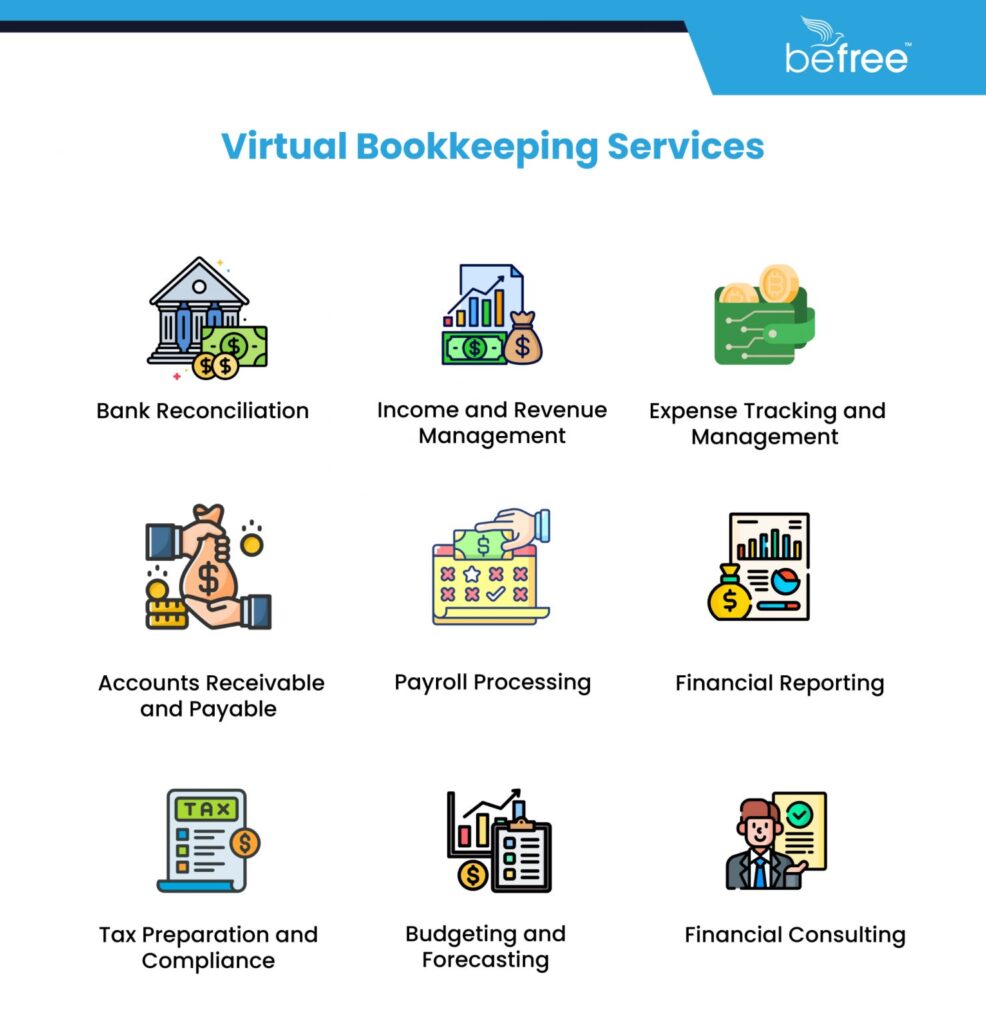

Here is a list of bookkeeping services you can look out for when you outsource to a professional virtual bookkeeper:

1. Expense Tracking and Management

A virtual bookkeeper meticulously records every expense, ensuring that your financial records are accurate and up-to-date. This detailed tracking helps you stay on top of your spending, identify trends, and find opportunities to cut costs.

2. Income and Revenue Management

They monitor your income streams, ensuring that all revenue is correctly recorded. This service helps you understand your cash flow and make informed decisions about reinvesting in your business.

3. Accounts Receivable and Payable

Managing invoices and payments can be a headache. Virtual bookkeepers handle your accounts receivable and payable, ensuring timely payments and maintaining good relationships with clients and suppliers.

4. Bank Reconciliation

To keep your financial records accurate, virtual bookkeepers perform regular bank reconciliations. This process matches your bank statements with your internal records, identifying any discrepancies and correcting them promptly.

5. Financial Reporting

Virtual bookkeepers generate comprehensive financial reports, including balance sheets, income statements, and cash flow statements. These reports provide valuable insights into your business’s financial health and help you make strategic decisions.

6. Tax Preparation and Compliance

Staying compliant with tax regulations is crucial. Virtual bookkeepers prepare your financial records for tax season, ensuring all necessary documentation is in order and helping you maximize deductions.

7. Payroll Processing

Managing payroll can be complex and time-consuming. Virtual bookkeepers handle payroll processing, ensuring your employees are paid accurately and on time, and taking care of all related tax filings.

8. Budgeting and Forecasting

Virtual bookkeepers assist in creating budgets and financial forecasts. These tools are essential for planning future growth, managing resources efficiently, and setting realistic financial goals.

9. Financial Consulting

Many virtual bookkeepers offer consulting services, providing expert advice on financial strategies, cost-saving measures, and growth opportunities tailored to your business.

Assess Your Requirements Before Choosing a Service

When considering outsourcing your bookkeeping, evaluate your specific needs and goals. Depending on the service provider you choose, you might only receive a subset of the above-listed services. Moreover, bookkeeping service packages can vary widely in cost and scope.

That said, it’s important to remember that professional financial insights are an investment, not an expense. Many online bookkeeping services offer valuable information at a fraction of the cost of an in-house team. The right virtual bookkeeper can provide the financial clarity and expertise to make strategic decisions without breaking the bank.

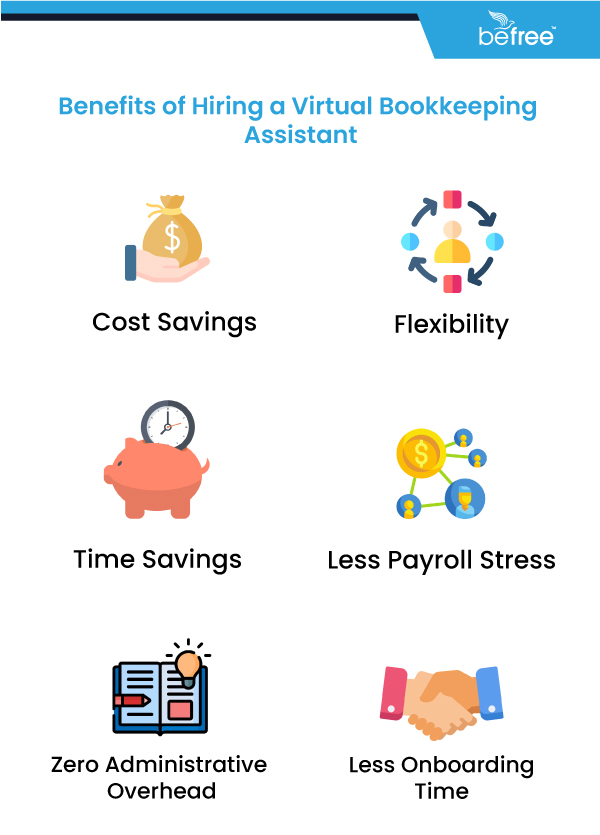

The Benefits of Hiring a Virtual Bookkeeper

Hiring an in-house bookkeeper can be a significant expense for your business. When you factor in the costs of salary, benefits, training, and overhead, the financial burden can quickly add up. An in-house bookkeeper also requires a dedicated workspace and equipment, further increasing operational costs.

In contrast, virtual bookkeeping services offer a more affordable and flexible solution. By outsourcing your bookkeeping, you gain access to experienced professionals who use the latest technology to manage your finances efficiently. This ensures accuracy and compliance and frees up your time to focus on core business activities.

Virtual bookkeepers can scale their services to meet your needs, providing the right level of support as your business grows, all without the high costs associated with in-house staff.

Key Takeaways

Outsourcing your bookkeeping to a virtual bookkeeper can change how you manage your business finances. As discussed, traditional bookkeeping methods often fall short as your business grows, leading to inefficiencies and stress. Investing in a virtual bookkeeper means you can focus on what matters most—growing your business, serving your customers, and achieving your vision.

Ready to Transform Your Business?

Take the first step towards efficient financial management and business growth today.